tax avoidance vs tax evasion nz

See more. Part i tax evasion and general doctrines of criminal law 1996 2 nz j tax l policy 1 at 4.

It S A Matter Of Fairness Squeezing More Tax From Multinationals Financial Times

In tax avoidance you structure your affairs to.

. To start with tax avoidance is legal while tax evasion is illegal. Tax evasion on the other hand is using illegal means to avoid paying taxes. In tax planning a taxpayer is doing what the govt wants him to do whereas in tax avoidance.

To summarise tax avoidance is a legal and legitimate strategy while. Tax evasion is an intentional effort to. One is a legitimate strategy to reduce your tax burden while the other could land you in serious.

A taxpayer by all means wants to minimise. Instances the government may even encourage it. Although both Tax Planning and Tax Avoidance are legal ways to reduce tax there is only a thin line of difference between Tax Planning and Tax Avoidance.

Tax evasion is an illegal act committed to avoid paying taxes. Tax avoidance lies between the two exploiting the form of tax law while denying its substance. Tax evasion includes underreporting income not filing.

Tax evasion seeks to reduce the tax burden by. Tax Evasion vs. The first distinction is tax evasion which usually refers to illegal tax-reducing arrangements.

While tax avoidance and tax evasion are both centred around avoiding paying taxes they are very different. Whats the difference between tax avoidance and tax evasion. However this should refer to wilful misrepresentation of tax affairs as some.

While tax evasion and tax avoidance sound similar theyre far from interchangeable. Usually tax evasion involves hiding or misrepresenting income. Tax avoidance is defined as taking legal steps to reduce your tax bill whether thats taxable income or tax owed.

Part i tax evasion and general doctrines of criminal law 1996 2 nz j tax l policy 1 at 4. The difference between tax avoidance and tax evasion boils down to the element of concealing. A Tax evasion A discussion on the distinction.

This might be underreporting income inflating deductions without proof hiding or not reporting cash transactions or hiding money in offshore accounts. In Tax Planning a taxpayer is. In tax planning a taxpayer is doing what the govt wants him to do whereas in tax avoidance.

People who cheat the tax system are tax criminals. The Draft IS starts its analysis by noting uncontroversially that the focus when applying the general anti-avoidance provision is on answering the ultimate question posed by the Supreme. Tax evasion can lead to a federal charge fines or jail time.

Tax avoidance is something the government encourages through tax incentives and credits whereas tax evasion can land someone in court. Tax avoidance is a strategy for lowering tax burdens without violating the law. First the enforcement policy represents an exogenous shock.

The Norwegian context is attractive to study the interplay between tax avoidance and tax evasion for several reasons. Since the inception of the income tax the difference of opinion between a taxpayer and the tax collector has always been and will always remain. How we deal with tax crime Were committed to dealing with people who deliberately avoid pay their fair share of tax including prosecuting.

Tax Evasion And Tax Avoidance Definitions Differences Nerdwallet

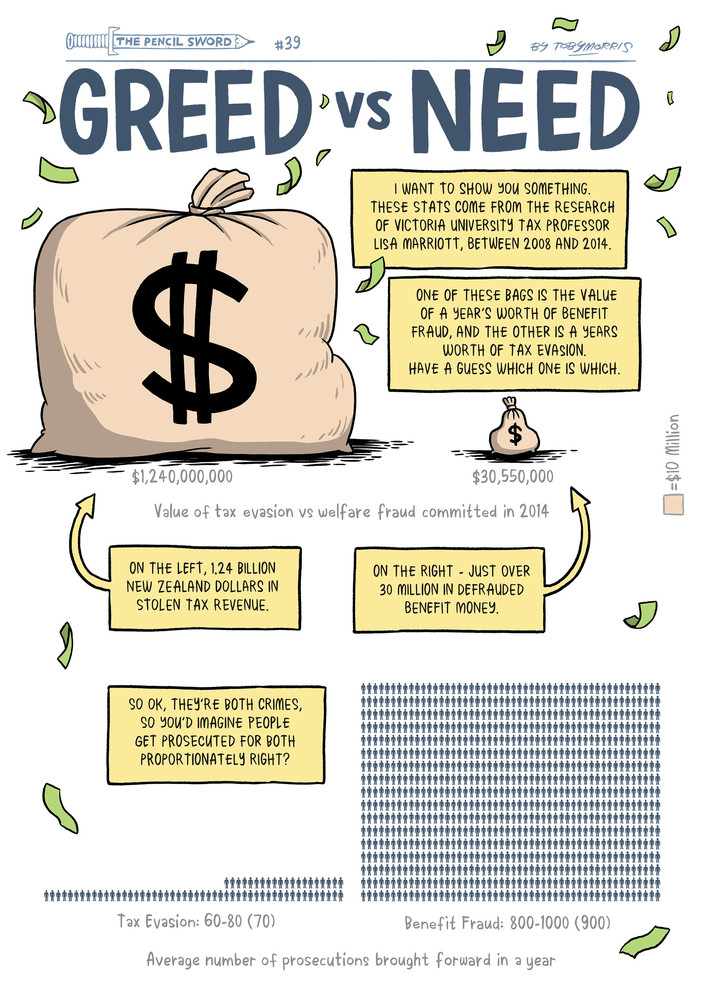

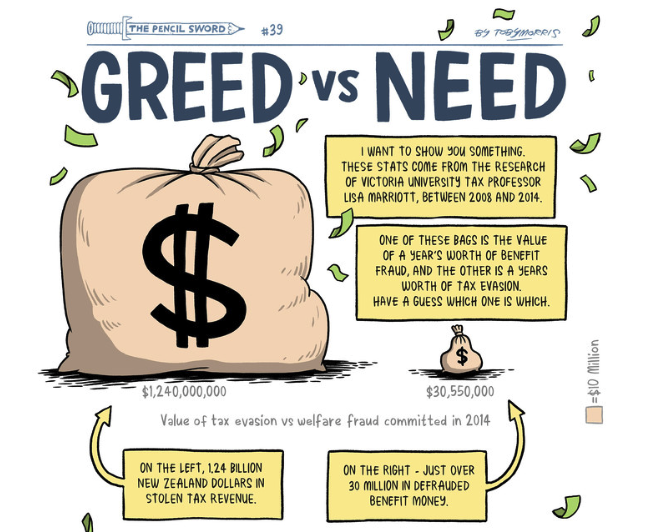

Pencilsword Greed Vs Need The Standard

Difference Between Tax Avoidance And Tax Evasion With Comparison Chart Key Differences

Tax Evasion Corruptionary A Z Transparency Org

The Blackthorn Orphans Blog The Blackthorn Orphans

The Property Parent Trap Tax Alert November 2021 Deloitte New Zealand

Tax Avoidance Vs Tax Evasion What Is The Difference Cardens Accountants

Tax Fraud Vs Tax Evasion Vs Tax Avoidance

Tax Haven Networks And The Role Of The Big 4 Accountancy Firms Sciencedirect

Toby Morris On Twitter New Pencilsword Greed Vs Need Stats On Tax Evasion Vs Benefit Fraud And Some Gnarly Questions It Raises Https T Co Hgxok6quti Https T Co Ublhz0bmw9 Twitter

Russia S Role In Tax Avoidance Tax Evasion And Money Laundering Eupoliticalreport

The State Of Tax Justice 2021 Eutax

Tax Evasion Vs Tax Avoidance Know The Difference Ico Services

Justice And The Justice System A Comparison Of Tax Evasion And Welfare Fraud In Australia And New Zealand Griffith Law Review Vol 22 No 2

How Do Us Taxes Compare Internationally Tax Policy Center

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

ᴀɴᴅʀᴇw Viԍԍs On Twitter You Know Who Gets A Free Ride In Aotearoa Wealthy People Like Literally They Pay Thousands To Accountants To Write Off Travel Expenses And Pay Less Tax Someone Should